First posted on the 2degreesNetwork on November 28th, 2013.

The laws of nature and the rules of business are currently in direct collision. Today, the biggest polluter makes the biggest profit. Short-term earnings govern financial analysts’ worldview, and a company that spends smart dollars for a healthy return within five years — both in profits as well as savings in energy, waste and water — well, that just doesn’t cut it with Wall Street. Short-term earnings trump long-term value. Therein lies the rub.

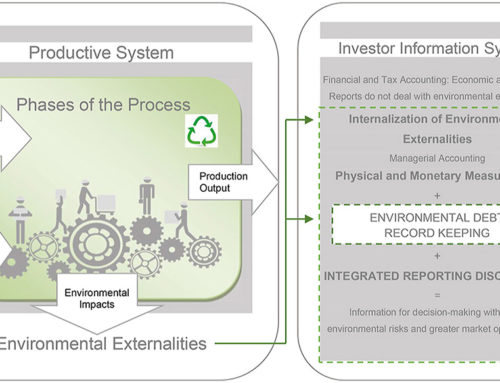

To counter this, confoundingly complex integrated reporting and natural capital accounting efforts are being led by both the giants and upstarts of the financial service industry, myriad trade associations and civil society organizations as well as the World Bank. But some of this work has already reached the shore.

Puma was the first company to create an Environmental Profit & Loss Statement (EP&L) that measured and accounted for both its 2010 profits as well as the company’s toll on the environment. This statement showed that Puma’s environmental costs would have eaten 72% of its annual profit, €145 million. Adding to its astonishing transparency, Puma convened experts across the spectrum to review and improve its EP&L methodology. Although the EP&L, with the aid of both PricewaterhouseCoopers and TruCost, went four levels down the supply chain, this new accounting is an imperfect science.

But all accounting is imperfect. One day your coal assets look hardy on your books, and the next year they look like stranded assets. As I note in my book, Environmental Debt: The Hidden Costs of a Changing Global Economy, “Ratan Tata recently admitted that the energy from his company’s new massive coal power plant in India will bring energy to market at roughly the same price as new solar. Tata actually described this plant as a ‘non-performing asset’ due to the increasing unavailability and high cost of coal.”

But today, the oil companies actually represent the highest risk for dangerous levels of stranded assets. Climate scientists are clear that our greenhouse gas emissions must remain under a two-degree scenario if we are to avoid climate catastrophe. However, the oil companies have over $20 trillion on their books that will be “unburnable” if we are to stay within emission levels that keep our planet habitable. This is how the rules of business and the laws of nature are in direct collision. The oil companies claim $20 trillion of unburnable reserves as an asset, and current accounting rules accept this as true. Sounds kinda like a subprime mortgage to me. Investors and institutions as varied as HSBC, Standard & Poor’s and the Grantham Institute have all weighed in on this high risk numbers game.

Back to Puma’s EP&L. The first ingredient of integrated reporting is courage. The courage to note a company’s shadow. KPMG computed that “In 2009, the 3,000 largest public companies were estimated to be causing $2.15 trillion of damage.” And China recently estimated that its environmental degradation was responsible for 3.5% of its GDP. (Wanna bet it’s more?) Clearly, something new in accounting is afoot. And one asset that cannot be overstated is courage.

Puma is now developing a more current and refined version of its 2010 EP&L. Actually, it’s going further. Puma’s parent company, Kering (Yves St. Laurent, Gucci, Stella McCartney, etc.) is creating an EP&L for all of its brands. So far, this is extraordinary courage, but besides the computation costs (not inconsiderable), the company is not yet alleviating or preventing the environmental damage it creates. Clearly, Kering’s intention after all of this extraordinary bother is to change its manufacturing, sourcing, transport, and operations to lessen its loadon the environment. Accounting rules and environmental policy should incentivize every company to do exactly this. The data that Kering is gathering is the key to creating these new rules, so that the rules of business respect the limitations of the laws of nature. And the biggest polluter then makes the smallest profit — or doesn’t operate at all!

Each of us, as businesspeople, citizens and individuals, are responsible for the rules of business, the policy that govern these rules, and the consumption that drives the overall economy. Courage is needed to change the profit paradigm and the quest for true profits is upon us. This is civilization’s most daunting challenge, and we must leave our comfort zones and rise to the occasion.

“Our most basic common link is that we all inhabit this small planet. We all breathe the same air. We all cherish our children’s future. And we are all mortal.” – John Fitzgerald Kennedy, June 10, 1963